Ecom in Australia is evolving faster than many businesses can keep up. New platforms, shifting shopper behaviours, and intensifying competition are rewriting the rules of retail almost overnight. Some brands are thriving by adapting quickly, while others are struggling to maintain relevance in a market where expectations are rising by the day.

In today’s market, providing convenience isn’t optional. The thriving brands are those that make the buying process as easy as possible while giving shoppers their preferred way to check out. Those who can’t keep up risk being left behind.

What separates the leaders from the rest isn’t luck but strategy. In this article, we’ll explore where Ecommerce in Australia is heading, how consumer habits are changing, and the strategies that will matter most for building long-term growth.

The State of Ecom in Australia

Ecommerce in Australia has grown steadily since its early days and entered an accelerated trajectory after the pandemic. With this shift in pace, understanding where the sector stands today becomes crucial for anticipating what comes next. These factors shape the strategies businesses need to thrive.

Market Size & Growth

Australia’s e‑commerce market is booming, with retail e‑commerce reaching US $46.2 billion in 2024 and total e‑commerce volume hitting US $89.4 billion. It’s forecasted to grow at around 6% annually, reaching US $107 billion by 2027.

As more households shop online and digital adoption accelerates, competition intensifies and customer expectations rise. The question is no longer whether to sell online, but how to keep pace with rising consumer demands.

Demographics

While every generation shops online, Millennials and Gen Z are the biggest drivers of growth, setting expectations for mobile-first experiences, flexible payments, and social shopping. Gen X and Baby Boomers are catching up, with older demographics increasingly comfortable making larger, higher-value purchases online.

E-commerce Consumer Spending by Generation (2023. Australia):

| Generation | Consumer Spending |

| Gen Z | US$7.1B |

| Gen Y | US$14.8B |

| Gen X | US$11.7B |

| Baby Boomers | US$8.3B |

Profile of the Australian Shopper

Australian shoppers are highly active online, but their habits reveal a mix of smaller basket sizes, high frequency, and limited loyalty.

- US$66 is the average basket size for each transaction.

- 1 in 7 Australian households make weekly online purchases

- 8 in 10 Australian households shopped online in 2023 (around 9.5 million households)

Businesses should focus on nudging up order values, rewarding repeat purchases, and building trust to stay top of mind.

Competitive Landscape

Data from IAB

The competitive pressure on Australian e-commerce has never been greater. Global giants like Amazon and Shein are rapidly gaining market share, setting new benchmarks for price, convenience, and delivery speed.

For smaller businesses, this creates a David-versus-Goliath challenge. How do smaller retailers compete when consumers are lured by the scale and resources of international platforms? That’s what we’ll cover in the next sections.

How Australians Shop Online (and How You Can Cater to It)

Knowing what Australians prefer when they shop online gives you the insight to fine-tune your strategy and meet them where they are. Let’s break down the key habits and explore how your business can cater to each.

Mobile-First Behaviour

A study shows that 73% of Australians use mobile devices to shop online, with mobile browsers being the most popular channel over apps and e-commerce platforms. Shoppers also expect speed, with even small delays in load time risking a significant drop in engagement and conversions.

Image courtesy of Google

To meet rising expectations, businesses must optimise design with smartphone screen-sized dimensions in mind. That means responsive layouts that adapt to any screen, compressed images for faster load times, and a streamlined checkout that removes unnecessary steps.

The Rise Of The “Buy Now, Pay Later” Scheme

Buy Now Pay Later (BNPL) has quickly gone from niche to mainstream in Australia, with 40% of Australians aged 18–39 already using BNPL services like Afterpay, Zip, and Klarna. Its appeal lies in allowing shoppers to split purchases into smaller instalments without background checks or interest when payments are made on time.

Offering Buy Now Pay Later (BNPL) at checkout can significantly reduce cart abandonment and increase average order values, as shoppers feel more comfortable spending when payments are spread out. To get the most value, businesses should highlight BNPL options prominently on product pages and during checkout, so customers immediately see the flexibility on offer.

Delivery Expectations

Meeting delivery expectations is the top trust factor for Australians, with 85% ranking reliable delivery as the most important reason to choose a retailer. Expectations are rising quickly, with same-day and next-day delivery and flexible pick-up options now widely expected in metro areas. Hence, it’s crucial to signal delivery reliability even before a purchase is made.

That trust starts on the website. Clear delivery timelines on product pages and checkout screens, postcode-based calculators, and visible partnerships with trusted carriers like Australia Post, DHL, or Toll all help set realistic expectations and reassure shoppers their orders are in safe hands.

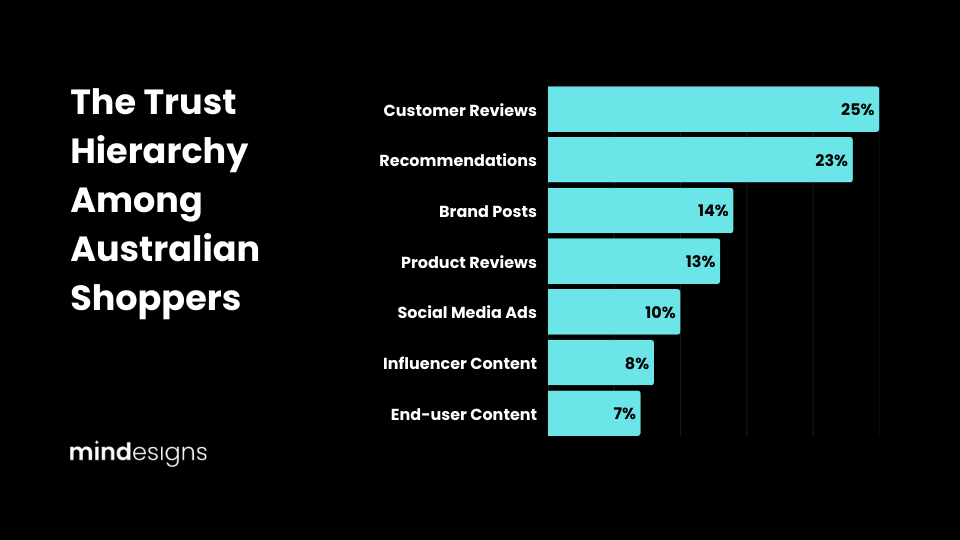

Trust Signals

Australians are cautious buyers. A study found that Australian shoppers rank customer reviews and rating at the top of the trust hierarchy.

Data from Bazaar Voice

For businesses, this means that reviews and ratings must be leveraged and appear prominently in their messaging. Testimonials with authentic visuals such as customer photos or short videos outperform plain text, with video boosting conversions by up to 25%.

Featuring this kind of social proof across product pages, social media, and email campaigns strengthens credibility and gives buyers the confidence to convert.

The Right Ecom Strategies That Move the Needle

Not every tactic in e-commerce delivers the same return. The challenge is knowing which levers to pull to see results that matter. Here are the top strategies we think will have an outsized impact on your business.

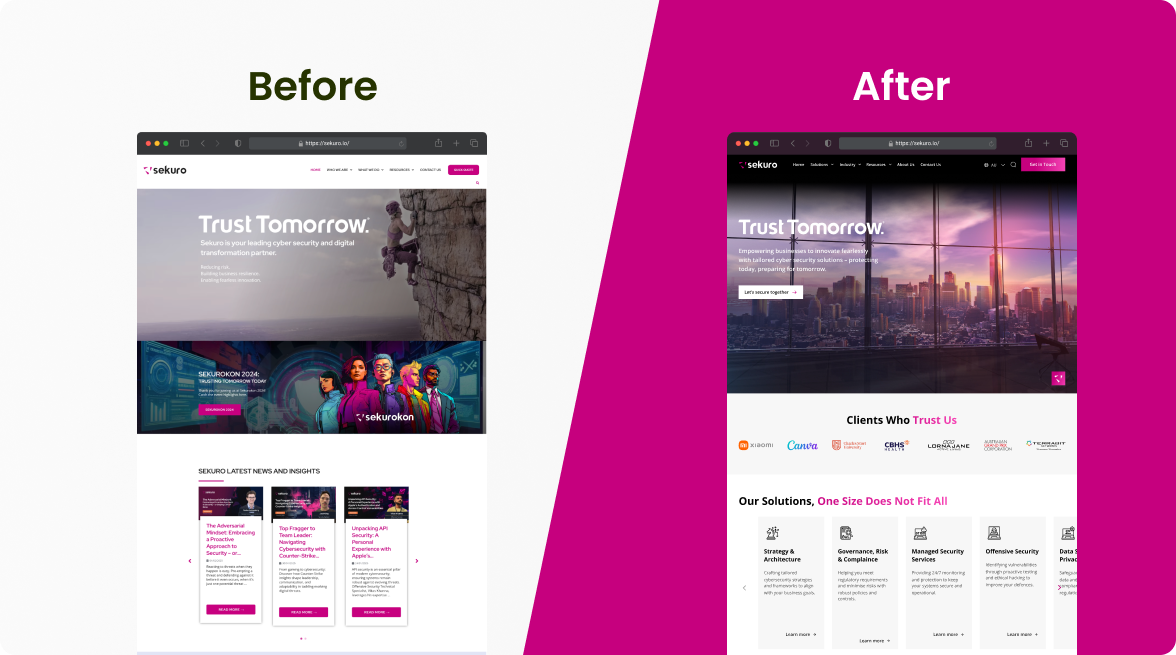

Investing In Frictionless UX

Every extra click, every confusing layout, and every second of delay creates friction that can push shoppers away.

Amazon set the standard here with its famous one-click checkout, showing how a frictionless purchase journey can transform conversions and customer loyalty. Shoppers now expect that same ease across all online stores, no matter the size of the retailer.

We at Mindesigns put these principles into action with its work for Jewellery Melbourne. By simplifying the site structure, streamlining the checkout process, and ensuring the design was mobile-first, the team reduced unnecessary clicks and improved overall flow. The result was a smoother experience that aligned with the brand and drove stronger sales.

Smarter Paid Media

According to reports, retail is still the #1 category in online ad spend in Australia, with 18% of digital display advertising coming from retailers. That means smaller businesses are often competing against industry giants with marketing budgets they can’t possibly match.

So how do smaller retailers fight back? By embracing smarter paid media strategies that focus on efficiency over volume. This means targeting high-intent audiences instead of casting a wide net, using data-driven optimisation to double down on what works. When done well, this approach enables smaller brands to compete toe-to-toe with larger players while saving on ad costs.

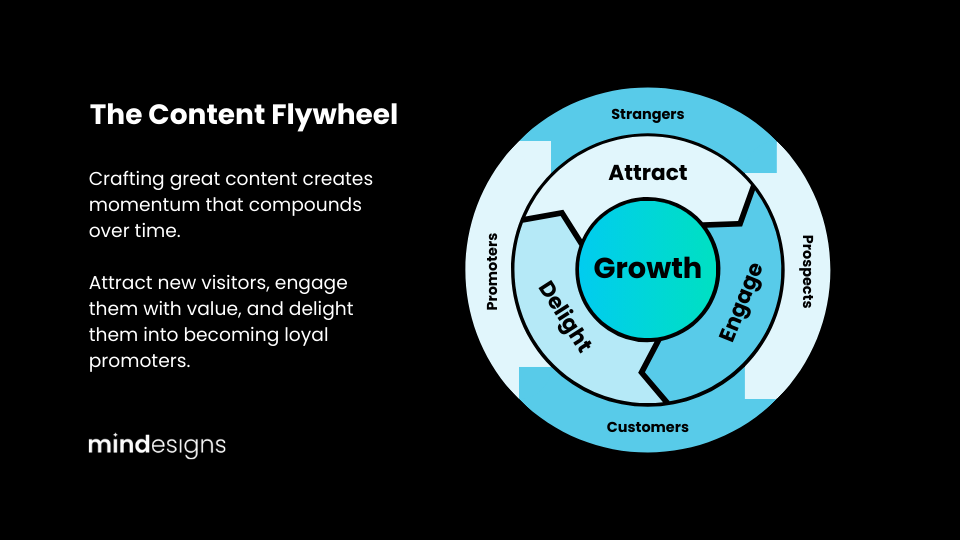

Build a Sustainable Conversion Flywheel with SEO and Content

Paid ads can deliver quick wins, but the moment you stop spending, the traffic dries up. By contrast, investing in SEO services and content create a compounding growth loop that builds momentum in the long run. Over time, this creates a sustainable flywheel effect where visibility leads to traffic and conversions.

The data shows just how powerful retailer content can be. 72% of shoppers say they always research a brand before purchasing it for the first time, with six in ten online shoppers read or watch retailer-produced content, with websites (84%) and emails (72%) leading the way.

The Content Flywheel concept, as popularised by HubSpot

To build a content flywheel, businesses first need to research and publish keyword-rich content that directly addresses the questions shoppers are asking. This means drilling into the real search intent behind queries. For example, instead of only targeting “women’s shoes,” content could focus on “best women’s running shoes for flat feet” or “how to style leather boots for work.” The key is to create a diverse content strategy that meets shoppers wherever they are in their journey.

Loyalty & Retention Marketing

With Australian shoppers using an average of 16 different online retailers a year, loyalty has become increasingly fragile. The real challenge isn’t getting someone to buy once, but ensuring they continue to buy from you.

Email marketing is one of the strongest tools to achieve this. EDMs offer a direct, personal channel for tailored offers, restock alerts, and abandoned email reminders that keep customers engaged. Paired with a well-structured loyalty program, email becomes a powerful retention engine that reduces churn and maximises customer lifetime value.

The Future of Ecom in Australia

The Australian e-commerce market is crowded and fast-moving, which means having the right strategy makes the difference between growth and stagnation. Let’s look at the new e-commerce strategies that really drive growth.

AI & Personalisation

With 79% of Australian consumers saying that personalised experiences will make them more loyal to a brand, it’s no wonder why Australian retailers are already leaning into AI to aid their marketing personalisation efforts.

One example is retail giant Woolworths, which partnered with analytics firm Quantium to harness customer data for personalised recommendations. By analysing shopping patterns and basket histories, they were able to suggest relevant products in real time, both online and through the Everyday Rewards program. This level of targeting has made customers up to five times more likely to purchase compared to mass marketing tactics.

Social Commerce Growth

Social-driven commerce is catching on quickly. In fact, a study shows that 74% of Gen Zs and Millennials shop via social media. Moreover, they are planning to shop more on social media in the next five years.

A great example of social commerce in Australia comes from MECCA’s collaboration with Charlotte Tilbury, where the beauty retailer launched an innovative shoppable livestream on TikTok. The livestream not only showcased Charlotte Tilbury’s products but also allowed viewers to purchase directly from MECCA’s website without leaving the TikTok app.

What makes this powerful is that it shortens the buying journey by giving the customers a way to purchase the items as they are discovering it all within a single viewing.

Cross-Border E-commerce

The appetite for international growth is accelerating. Recent research shows that 40% of Australian businesses plan to expand overseas within the next two to five years. This wave of cross-border expansion will heighten competition, with local brands competing not only with each other but also with established global players.

Brisbane-based BlackMilk Clothing shows how SMEs can succeed abroad. By producing bold, limited-run designs in-house and building a community through social media and user-generated content, the brand created a sense of exclusivity and belonging that fuelled organic global growth.

Omnichannel Presence

Today’s shoppers expect a seamless journey across online, social, and physical touchpoints. They might discover a brand on Instagram, compare on Google, and finish the purchase in-store or online, all while expecting consistent messaging and service.

Coles is a strong example of omnichannel retail in Australia. Its ecosystem spans the Coles app, online store, shoppable catalogues, Flybuys loyalty program, and social channels, all connected to create one brand experience. A shopper can browse specials in the app, add items to an online basket, earn Flybuys points in-store, and later receive personalised email offers, with each step tied neatly together.

Building a Future-Ready Ecom Strategy

The lesson for businesses is clear. E-commerce in Australia is no longer just about having an online store, it’s also about building an ecosystem of connected touchpoints that customers can move through effortlessly. As the landscape continues to evolve, retailers who integrate their digital marketing, logistics, and customer experience will be the ones who thrive.

At Mindesigns, we help brands bridge these gaps, combining web design, SEO, paid media, and analytics with an understanding of Australian shoppers’ expectations. Contact us today to see how we can help you build a future-ready e-commerce strategy.