Minimising Tax for Small Businesses

Taxes can feel overwhelming for small business owners, especially if you’re not well-versed in how to make the most of tax season. But with a solid understanding of tax laws, you can unlock valuable opportunities to boost your profitability, by paying less tax. In this article, we’ll explore how you can leverage tax offsets and deductions to reduce your tax liability and keep more in your pocket.

While taxes may seem straightforward at first glance, the process is often more complex. Many businesses miss out on substantial savings by overlooking key deductions and offsets. But by focusing on these two strategies, you can make a big difference in your financial outcome. Let’s break down how each works.

Understanding Small Business Tax Offsets

Tax offsets can slightly reduce your overall tax burden, offering modest relief.

Unlike deductions that lower your taxable income, offsets directly decrease the amount of tax you owe. This mechanism provides financial incentives or relief to small businesses, by directly reducing how much tax they have to pay.

Tax offsets for small businesses are generally modest in comparison to other forms of tax relief. While some tax offsets can result in meaningful savings, such as the small business income tax offset (currently capped at $1,000 per year), they typically provide smaller financial benefits compared to deductions or incentives like the instant asset write-off scheme.

The ATO website offers valuable resource for small businesses during the tax season to help with your taxes, called the ATO Tax Time Toolkit. It provides a range of information and tools to help businesses understand their tax obligations, prepare their tax returns, and claim eligible deductions. with information that can help small businesses at tax time.

By using the ATO Tax Time Toolkit in conjunction with the information provided in the article, you can gain a more comprehensive understanding of your small business’s tax obligations and make informed decisions. The toolkit is available for download here.

Types of Tax Offsets for Australian Businesses

Small businesses can often benefit from specific offsets tailored to their unique circumstances. Here are the most common examples:

Small business income tax offset

The small business income tax offset (SBITO) is a tax break for eligible small businesses. It can reduce the tax you pay by a maximum of $1,000 annually. To qualify, you must be a sole trader, partner in a small business partnership, or beneficiary of a small business trust.

What’s interesting is that the SBITO isn’t a flat $1,000 deduction. It’s a graduated offset, meaning the amount you receive depends on your total net small business income and your tax payable on that income.

To calculate, the offset is applied as a percentage of the tax payable on your net small business income. If your net small business income is greater than or equal to your taxable income, the offset is based on your basic income tax liability for the year.

Eligibility Criteria — The SBITO is calculated based on your net small business income and the tax you owe. The business must have an aggregated turnover of less than $5 million.

You can claim the offset if you have a share of net small business income from a partnership or trust. However, you can’t claim the offset for business income derived by another partnership or trust you aren’t a partner or beneficiary in.

If you’re a partner or beneficiary, any deductions you claim will reduce your share of net small business income. However, some deductions, such as tax-related expenses and personal superannuation contributions, won’t reduce your share.

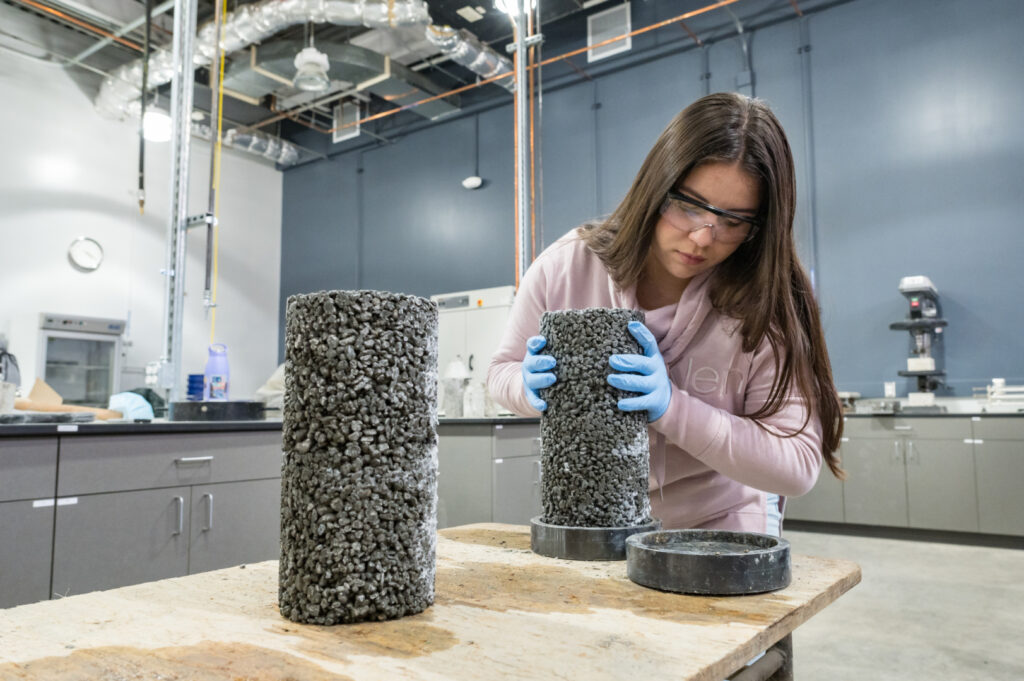

Research and development tax incentive

The Research and Development tax offset is a tax incentive available to eligible companies that conduct research and development activities. To qualify for the offset, your company must have total notional deductions of at least $20,000. If your notional deductions are less than $20,000, you can only claim the offset for certain types of R&D expenditure.

Eligibility Criteria — To be eligible for the R&D tax incentive, your small business must must be a registered R&D entity. This means you are a body corporate incorporated under Australian law or a foreign law, and you are operating in Australia. If you’re a foreign company, you must be an Australian resident for income tax purposes or carry on business in Australia through a permanent establishment as defined in a double tax agreement.

Second, you must have registered your R&D activities with AusIndustry. This government agency oversees R&D programs in Australia. Third, your R&D activities must meet the definition of R&D as defined by the Australian Taxation Office (ATO). This generally involves a systematic investigation or experimentation to acquire new knowledge or create new products or processes.

Fourth, you cannot be an ineligible entity. Individuals, corporate limited partnerships, exempt entities (such as charities), and most trusts are generally not eligible. Finally, your R&D activities must be carried out in Australia, and you must maintain adequate records to support your claims.

Foreign income tax offset

The foreign income tax offset (FITO) is a tax break that reduces your Australian tax liability if you’ve already paid income tax on foreign income in another country. This prevents you from being double taxed on the same income.

FITO is typically available to companies that operate in foreign markets, like companies that have subsidiaries, branches, or investments in other countries; generate foreign income from sales, services, investments, or other activities; and pay foreign taxes in the country where they operate.

Eligibility Criteria — To qualify for the FITO, you must have paid a foreign income tax and included the foreign income in your Australian taxable income. You can only claim the offset after you’ve actually paid the foreign tax and converted all foreign income amounts (income, deductions, taxes) into Australian dollars.

The FITO first reduces your income tax payable. Any remaining offset amount can then be used to reduce your Medicare levy and surcharge.

Most Common Tax Deductions

Small businesses can significantly reduce their taxable income by understanding and claiming common deductible expenses. These expenses can range from day-to-day operating costs to investments in business growth.

Here are some of the most common deductible expenses:

Day-to-day operating costs: Deductions for rent, utilities, property taxes, phone, internet, office supplies, printing, stationery, and bank fees.

Marketing and advertising: Deductions for website design, hosting, social media marketing, SEO, brochures, and other marketing materials, such as the maintenance of your business website.

Vehicle expenses: Deductions for fuel, repairs, maintenance, and registration fees for your company car, like the van you use for delivering goods to and from your partners or clients.

Travel expenses: Deductions for flights, accommodation, and meals during business trips, like booking flight and accommodations for your employees attending a seminar or conference overseas.

Staff costs: Deductions for salaries, wages, and superannuation contributions.

Depreciation: Deductions for the gradual decrease in value of business assets over time, such as a portion of the cost of your business computers each year.

Home office expenses: Deductions for a portion of rent, mortgage, utilities, and other expenses related to a dedicated home office space. Ask your tax expert about deducting a portion of your home insurance premium based on the area of your home used for business.

Professional development: Deductions for expenses related to attending industry-relevant courses, workshops, or conferences, such as registration and fees for said courses.

Interest on business loans: Deductions for interest paid on loans used to purchase business assets or fund operating expenses like new equipment for your business.

Bad debts: Deductions for unrecoverable debts, provided you can prove they are uncollectible. You can deduct the amount of a customer’s unpaid invoice if you can prove that the customer is no longer in business.

Software subscription fees: Deductions for subscription fees for software used for business purposes such as marketing and accounting software subscriptions.

Avoiding Illegal and Incorrect Business Deductions

While it’s important to maximise legitimate deductions to reduce your tax liability, claiming inappropriate deductions can lead to penalties and legal consequences. Here are some common mistakes to avoid:

Entertainment expenses related to entertaining clients or customers can be deductible if they directly benefit your business. However, personal entertainment expenses, such as dining out with friends or family, are generally not deductible. For example, expenses for a business dinner with a potential client are generally deductible, while expenses for a personal dinner with friends are not.

Traffic fines incurred due to traffic violations are not deductible, even if they occur while driving for business purposes, so a parking ticket received while on a business trip is not deductible.

Private or domestic expenses related to personal or household matters, such as childcare fees or personal clothing, or those that are seen as a personal benefit are generally not deductible. For instance, Childcare fees for your children are not deductible, even if you work from home.

Non-compliant payments. If you have not met your Pay As You Go (PAYG) withholding or reporting obligations for payments made to suppliers or contractors, you may not be able to claim a deduction for those payments.

Goods and Services Tax (GST) component of business purchases can be claimed as a GST credit on your Business Activity Statement (BAS), but it is generally not deductible as a separate expense. For example, if you buy a new computer for your business, you can claim the GST portion as a credit on your BAS. However, you can only claim the net amount (excluding GST) as a business expense deduction, not the full purchase price including GST.

Cost of capital assets, such as buildings and property, is not immediately deductible. Instead, they are claimed as depreciation over time. However, there are exceptions for capital works, plant, and certain improvements for primary producers. For example, if you purchase a new building for your business, you cannot claim the full purchase price as a deduction in the year of purchase. Instead, the cost must be depreciated over the building’s useful life, with capital works deductions available for eligible improvements.

Common Loopholes in Australian Tax Laws

Every savvy business knows that staying compliant with tax regulations is key, but there are also perfectly legal and ethical ways to reduce what you owe. Want to know some of the most common tax loopholes businesses use to keep more of their profits? Here are a few strategies that can make a big difference for small businesses:

Income Splitting involves dividing income among family members to take advantage of lower tax brackets. This can be achieved through family trusts or partnerships. By diverting income to family members who are in lower tax brackets, taxpayers can reduce their overall tax liability.

Potential issue: The ATO has strict guidelines for income splitting, particularly when family members are not actively involved in generating that income. If the ATO determines that income splitting is artificial or lacks commercial reality, it may not be recognised for tax purposes.

Negative Gearing on Property allows taxpayers to deduct losses from investment properties from their other taxable income. This occurs when the costs of owning an investment property (interest on the loan, maintenance, and other expenses) exceed the rental income.

Potential issue: While negative gearing is a widely used strategy, it has been a point of political debate due to its impact on housing affordability. Critics argue that it can inflate property prices and make homeownership more difficult for first-home buyers.

Capital Gains Tax Discount (CGT) discount provides a 50% discount on the CGT payable when selling assets that had been held for more than 12 months, such as property and shares.

Potential issue: The CGT discount has been criticised as a way for wealthier individuals to pay less tax on significant investment gains. Some argue that it should be phased out or limited to certain types of assets.

Use of Trusts allow individuals to distribute income and capital gains to beneficiaries who might be in lower tax brackets, reducing the total tax paid. This can be achieved through family trusts or discretionary trusts.

Potential issue: The ATO closely monitors the misuse of trusts for income splitting or tax evasion purposes. If the ATO determines that a trust is being used inappropriately, it may not be recognised for tax purposes.

Fringe Benefits Tax (FBT) Concessions can help minimise the tax liability on non-cash benefits provided to employees. Certain fringe benefits, such as company cars or salary packaging, can be structured in a way to reduce the FBT liability for the employer, while still providing value to employees.

Potential issue: While some benefits are exempt or have concessions, employers need to ensure they follow the rules strictly to avoid FBT audits to avoid penalties.

Small Business Concessions such as the instant asset write-off, simplified depreciation, and CGT concessions. These can significantly reduce taxable income.

Potential issue: While legal, the misuse or misreporting of small business status to qualify for these concessions can lead to ATO audits. If the ATO determines that a business is not eligible for small business concessions, it may be subject to penalties.

Work-Related Deductions like claim deductions for work-related expenses that are either not eligible or inflated. This can include deductions for travel, uniforms, and home office costs.

Potential issue: The ATO has been increasingly scrutinising work-related deductions, with stricter audits in place. Overstating deductions can lead to penalties and interest charges.

Self-Education Expenses allow individuals to claim deductions for self-education expenses if the courses are related to their current employment. However, some taxpayers try to claim education expenses that are not directly linked to their job.

Potential issue: The ATO requires a clear connection between the education and the current employment. If the ATO determines that the education is not related to the taxpayer’s employment, the deduction may not be allowed.

Salary Sacrifice for Superannuation involves diverting a portion of your pre-tax income into your superannuation fund. This reduces your taxable income and can result in lower tax on super contributions.

Potential issue: While salary sacrificing can be a beneficial strategy, excessive contributions might push individuals over their contribution caps, leading to additional tax penalties.

Dividend Washing involves selling and repurchasing shares around dividend payment dates to claim franking credits twice for the same parcel of shares.

Potential issue: Dividend washing is illegal in Australia, and the ATO has been cracking down on this practice. If caught, individuals may face penalties and interest charges.

Tax Terminologies

Tax can be an overwhelming topic to get into. Here is a glossary of terms for those who are not familiar with taxation in Australia:

Aggregated Turnover — The total income of a business, including income from all its operations and any related entities.

Capital Gains Tax (CGT) — Tax payable on the profit made from the sale of certain assets, including business assets.

Fringe Benefits Tax (FBT) — A tax levied on employers for providing non-cash benefits to their employees.

Goods and Services Tax (GST) — A broad-based consumption tax levied on most goods and services sold in Australia.

Notional Deductions — A calculated amount used to determine eligibility for certain tax offsets, such as the Research and Development Tax Incentive.

Superannuation — A retirement savings scheme in Australia.

Taxable Income — The amount of income subject to taxation after deductions and offsets have been applied.

Tax Audit — An examination of a taxpayer’s records to verify the accuracy of their tax returns.

Tax Credits — Reductions in tax liability that are not directly related to income or deductions.

Tax Liability — The total amount of tax owed to the ATO.

Tax Loss Carry-Forward — The ability to carry forward losses from one income year to offset income in future years.

Tax Return — A document submitted to the Australian Taxation Office (ATO) that declares your income, deductions, and tax liability.