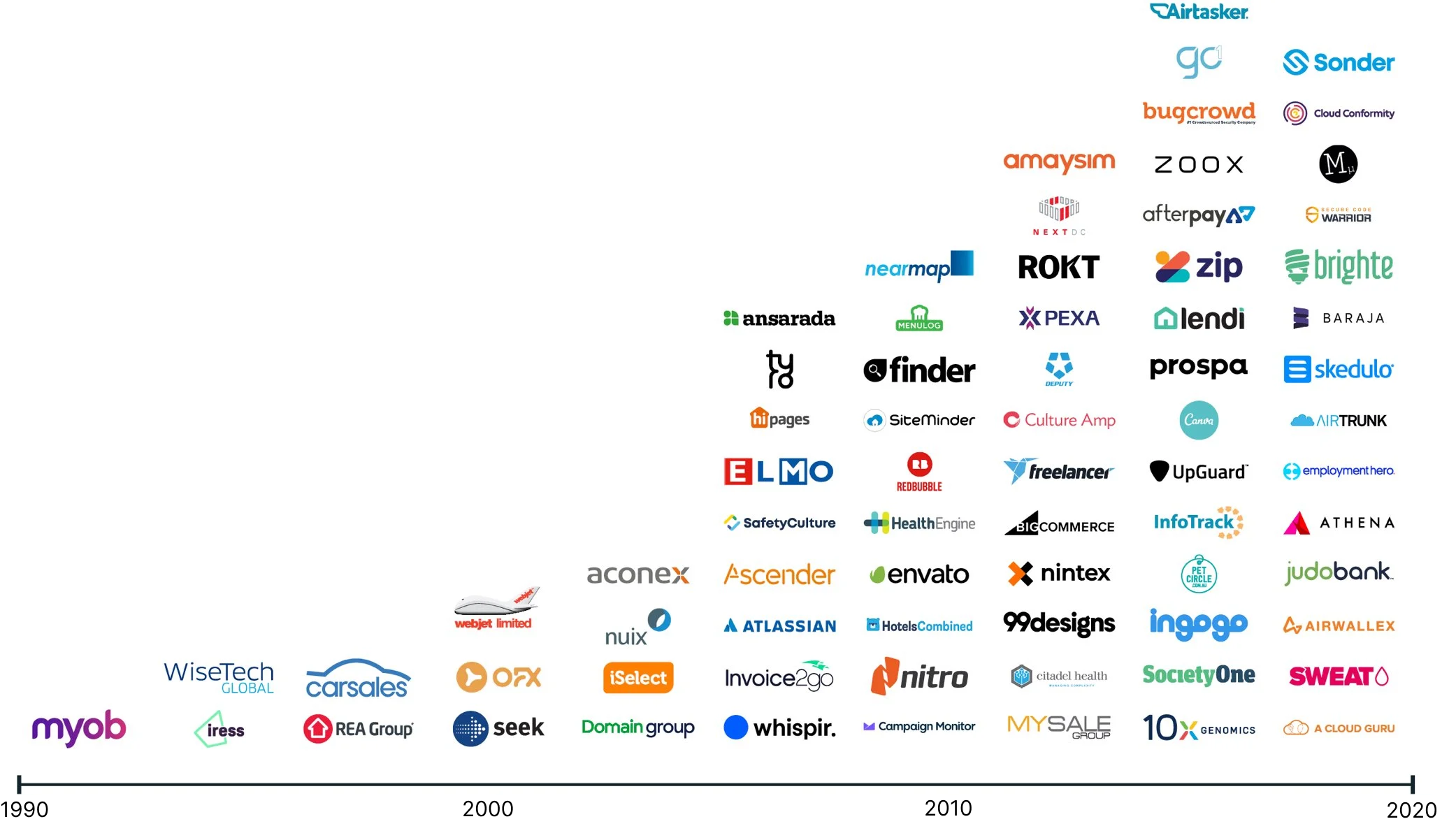

The current landscape of Startups in Australia

In recent years, Australia’s startup ecosystem has rapidly evolved, becoming a beacon of innovation and entrepreneurship in the Oceania region. This transformation is underpinned by significant growth in early-stage funding, a testament to the burgeoning confidence in Australian startups.

From 2018 to 2022, Oceania, primarily led by Australia, experienced an unparalleled 152% increase in Series B+ deal amounts, an 81% increase in Series B+ deal count, and a 60.7% increase in early-stage funding amounts. This growth trajectory positions Oceania, and specifically Australia, as the region with the highest growth in early-stage funding globally.

Sydney, Australia’s premier startup hub, has maintained its top position within Oceania, showcasing a remarkable 50% growth in ecosystem value and an increase in the number of unicorns, signaling robust investment activities and successful exits. Melbourne, not far behind, has seen a significant rise in its ecosystem value and early-stage deals, further cementing Australia’s status on the global startup stage. Other cities like Perth, Canberra, Brisbane, and Adelaide are emerging as pivotal ecosystems, each contributing uniquely to Australia’s overall innovation landscape.

The Australian startup funding landscape, however, faced challenges in 2023, with total reported deals and funding experiencing downturns. Despite this, sectors such as Enterprise/Business Software, Fintech, and Hardware/Robotics/IoT continued to attract substantial investments. Notably, there’s a growing investor interest in Artificial Intelligence, ClimateTech/CleanTech, and Enterprise/Business Software, indicating a shift towards sectors deemed critical for future growth.

A Quick Guide to Find Startups for Investing

Investing in startups is an exciting avenue for those looking to diversify their investment portfolio and contribute to innovation. However, it’s crucial to understand the different pathways available and to choose one that aligns with your risk tolerance, investment capacity, and interests. Here’s a breakdown of various avenues for investing in Australian startups, complete with examples and considerations for potential investors.

Venture Capital Firms

- Introduction: Venture Capital (VC) firms pool funds from investors to invest in high-potential startups, offering significant financial resources, mentorship, and strategic guidance.

- Examples:

- Blackbird Ventures: Focuses on Australian and New Zealand startups across various stages, known for investing in companies like Canva and Zoox. Visit Blackbird Ventures

- Square Peg Capital: Targets technology startups in Australia, Israel, and Southeast Asia, with investments in companies like Airwallex and Canva. Visit Square Peg Capital

- Investor Profile: Suitable for institutional investors or high-net-worth individuals who prefer a hands-off investment approach, accepting higher risks for potentially higher returns. VC investments are less liquid and typically require a longer-term commitment.

- Risk and Reward: Higher risk due to the potential for startup failure, but with the opportunity for substantial returns on successful exits.

Angel Investing Networks

- Overview: Angel investors provide capital to startups in their early stages in exchange for equity. They often bring industry experience and networks in addition to funding.

- Examples:

- Sydney Angels: An angel group investing in early-stage companies, offering both capital and expertise to help startups grow. Visit Sydney Angels

- Scale Investors: Focuses on empowering female entrepreneurs through early-stage investments, supporting gender diversity in the startup ecosystem. Visit Scale Investors

- Investor Profile: Ideal for individuals who wish to play a more active role in the startups they invest in, offering both capital and mentoring. Suitable for those who can afford to take risks with a portion of their investment portfolio.

- Risk and Reward: High risk given the early stage of the businesses, but provides the satisfaction of directly supporting entrepreneurship and the potential for high returns.

Equity Crowdfunding Platforms

- Explanation: Equity crowdfunding allows individuals to invest small amounts of money in startups in exchange for equity, democratizing access to startup investments.

- Examples:

- Birchal: A leading platform for equity crowdfunding in Australia, it has facilitated investments in a wide range of startups. Visit Birchal

- Equitise: Offers a curated selection of startups for investment, making it easier for everyday investors to access early-stage opportunities. Visit Equitise

- Investor Profile: Suitable for retail investors looking to enter the startup investment space with smaller amounts of capital. It offers a more accessible entry point for those looking to diversify into startups with lower investment minimums.

- Risk and Reward: While still risky, the ability to invest smaller amounts reduces the overall exposure. Investors have the chance to support startups they believe in with the potential for growth.

Startup Incubators and Accelerators

- Importance: These programs support early-stage startups by providing mentorship, resources, and sometimes capital in exchange for equity. They’re crucial for startup development and scaling.

- Examples:

- Startmate: Offers an accelerator program for startups in Australia and New Zealand, providing funding, mentoring, and access to a network of investors and alumni. Visit Startmate

- BlueChilli: Connects startup founders with corporate clients, investors, and mentors, focusing on technology-driven startups. Visit BlueChilli

- Investor Profile: Best for investors interested in early-stage companies who may also wish to contribute expertise or networks. Participation often comes through direct investment in the incubator or accelerator or in startups graduating from these programs.

- Risk and Reward: Investments in very early-stage companies carry high risk, but participating in incubator or accelerator programs can mitigate this through structured support and validation.

Online Platforms and Social Media Groups

- Overview: Digital platforms and social media groups offer a space for startups and investors to connect, share opportunities, and foster a community of innovation.

- Examples:

- LinkedIn Groups such as “Australian Startups” or “Sydney Startups” where members share investment opportunities, advice, and support. Explore LinkedIn

- AngelList: A platform for startups, angel investors, and job-seekers looking to work at startups. It provides a global network, including Australian startups and investors.

- Investor Profile: Ideal for those looking to actively engage with the startup community, discover new opportunities, and leverage a network for due diligence. It suits investors who prefer a hands-on approach to scouting and supporting potential investments.

- Risk and Reward: Varied risk depending on the stage and nature of the startup. Online platforms allow for broader due diligence and networking, potentially reducing risk through informed decision-making.

Tips for Conducting Due Diligence on Startups

Before diving into the world of startup investments, it’s crucial to conduct a thorough examination and understand the broader context in which these investments operate. This section will guide you through key pre-investment considerations, including conducting due diligence, navigating the legal and regulatory framework, and assessing startup viability.

- Team Evaluation: The strength and experience of the startup’s team are paramount. Look for a diverse group with complementary skills, a strong track record, and the resilience to navigate the ups and downs of startup life.

- Market Analysis: Understand the market in which the startup operates. Assess market size, growth potential, competition, and the startup’s unique value proposition. A startup should address a clear need or problem with a scalable solution.

- Financial Health and Projections: Review the startup’s financial statements, cash flow projections, and fundraising history. Evaluate their revenue model, profitability timeline, and how they plan to use the funds they’re seeking.

- Product/Service Viability: Evaluate the product or service’s stage of development, technological innovation, intellectual property, and user feedback. It’s crucial to assess not just the current state but the potential for future development and scalability.

- Legal and Regulatory Compliance: Ensure the startup has no pending legal issues and complies with industry regulations. This includes patents, trademarks, and necessary licenses.

- Customer and Market Validation: Look for evidence of customer interest and market validation, such as early sales, partnerships, or user testimonials.