Business Cost of Public Liability Insurance might not be the sexiest line item in your budget, but let’s be honest, it’s the one that could save your business from financial ruin.

In the 90s, there was a well-publicised McDonald’s case where an 85-year-old woman got burned by the chain’s hot coffee. She was awarded hundreds of thousands as compensation. From a hot coffee!

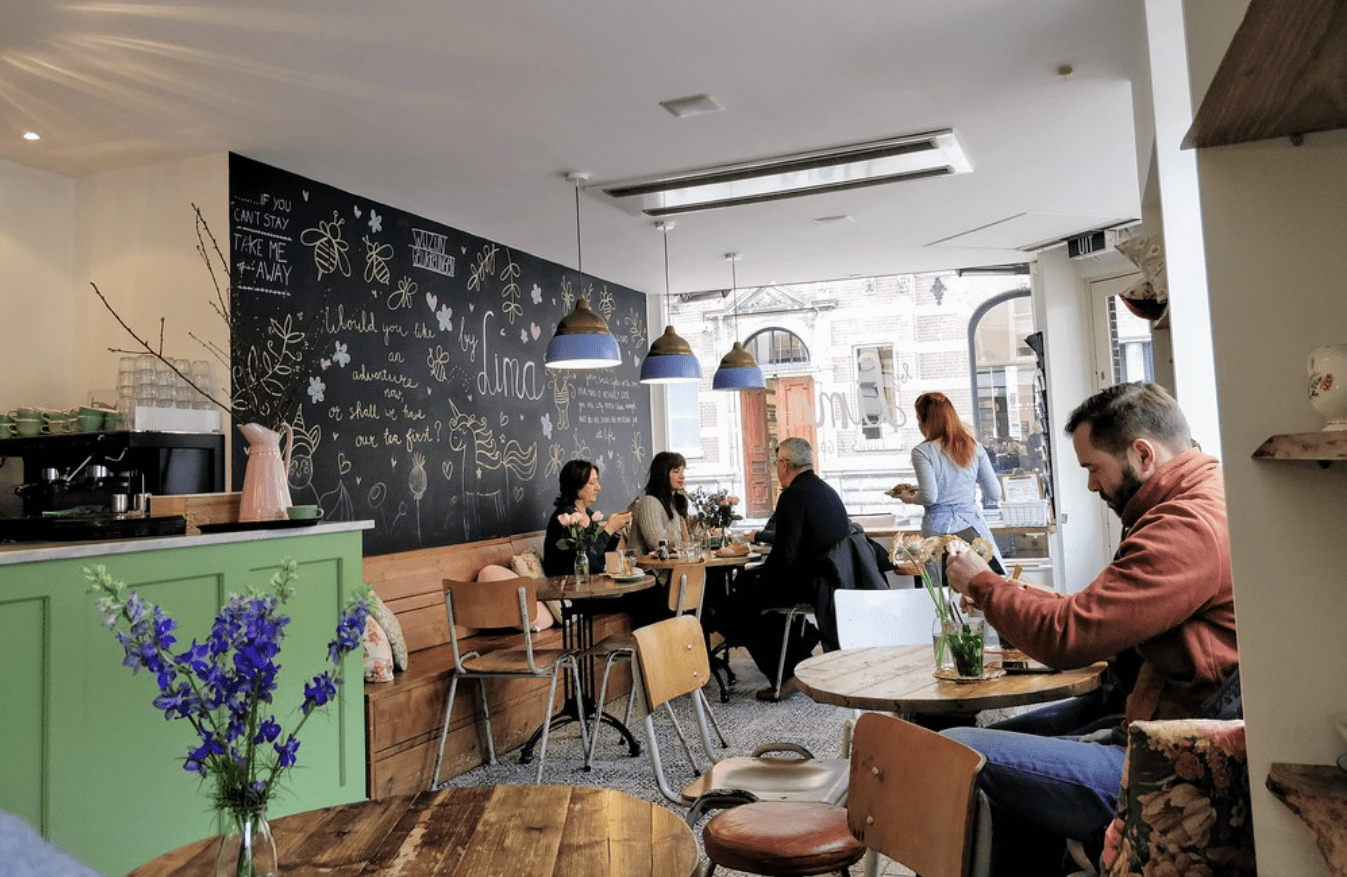

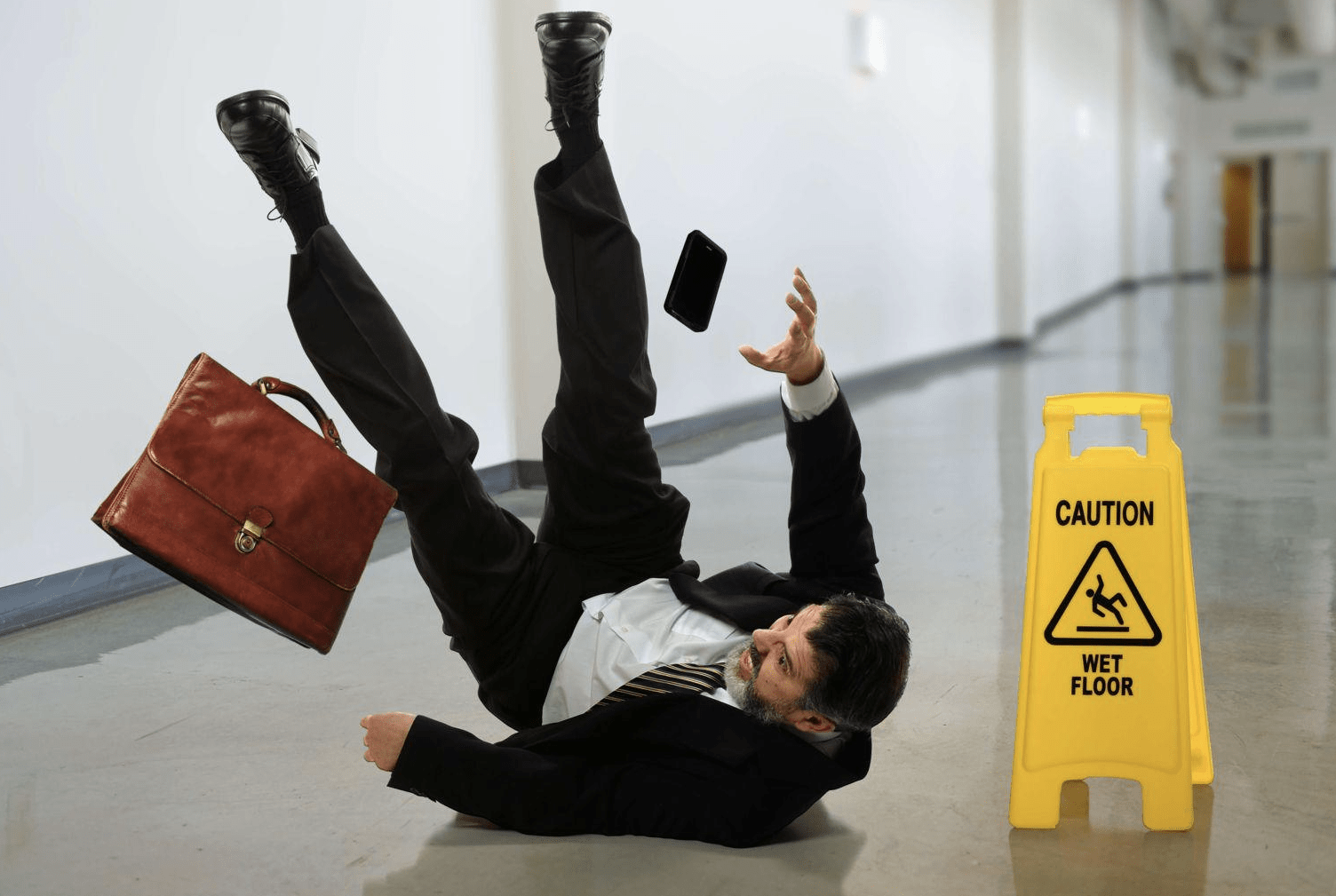

Now imagine you’re a café owner in Sydney without McDonald’s fortune to back you up. It’s Saturday morning, the place is buzzing, and one of your regulars slips on a recently mopped floor. The fall breaks their wrist, and the next thing you know, a compensation claim lands on your desk.

Without public liability insurance, you’re staring down the barrel of medical costs, legal fees, and potential damages in the tens of thousands. After this accident, that monthly business insurance cost doesn’t look like a luxury. It’s a lifeline.

Why Public Liability Insurance is More Than Just a Line Item

Too often, insurance is seen as a passive expense. Something you grudgingly tick off the list each financial year. But it’s not a passive expense. Public liability insurance is active protection, like a safeguard that keeps your business standing when things go sideways. And trust us, they do.

Maybe you hired a third-party worker to a client’s home who got into an accident. Perhaps you’re hosting a market stall, and a visitor trips over your signage. It doesn’t matter if it was a fluke or a moment of distraction. If someone gets hurt or something gets damaged, they can sue you, even if it’s not your direct fault.

Public liability insurance steps in when things go wrong. It helps you cover legal fees, compensation costs, and medical expenses. It’s business survival.

What is Public Liability Insurance and What Does it Cover?

At its core, public liability insurance protects you if someone claims you’ve caused them injury or damaged their property during your business activities.

This type of insurance is especially important for businesses that interact with the public, such as:

- Tradies: Plumbers, electricians, and builders who work in homes or commercial properties

- Hospitality: Cafés, bars, restaurants, and food trucks

- Event organisers: From wedding planners to music festival operators

Take note that public liability insurance is different from professional indemnity insurance, which covers you for advice or services gone wrong, and product liability insurance, which relates specifically to defective products.

Public liability is about accidents that happen on-site, at events, or during face-to-face interactions. Typical coverage includes third-party personal injury, third-party property damage, legal defence costs, and compensation payouts in case your business is found liable.

What Drives the Business Cost of Public Liability Insurance?

There’s no one-size-fits-all price tag. Your premium will depend on several risk factors that insurers weigh carefully:

Industry risk

High-risk professions like construction or event management attract higher premiums due to the greater chance of incidents. For example, a builder working on scaffolding has a much higher exposure to risk than a web developer working from home.

Business size and turnover

The more customers you serve and the more staff you have, the greater the potential for something to go wrong. Insurers use this to gauge your exposure to liability claims.

Location

Businesses based in densely populated or high-traffic urban areas (like Sydney’s CBD) typically pay more due to increased public exposure compared to those in low-traffic regional locations.

Claims history

A track record of previous claims significantly raises your premium. It signals to insurers that your business may present higher-than-average risks.

Level of coverage and excess

Opting for higher coverage amounts (for example, $20 million instead of $5 million) will increase your premiums. On the other hand, choosing a higher excess (the amount you pay out-of-pocket for a claim) can lower your premium, but only if your business can comfortably cover the cost when needed. Don’t just go with the cheapest option. Go with what keeps your business protected.

How Much is the Business Cost of Public Liability Insurance?

Here’s a rough guide to the annual cost of public liability insurance, depending on your industry:

| Industry | Risk Level | Approx. Annual Premium |

| Cafés, Bars and Restaurants | Medium | $800–$1,800 |

| Hospitals and Medical Clinics | High | $2,000–$5,000+ |

| Childcare Services | High | $2,500–$5,500+ |

| Construction, Electrical, Plumbing | Very High | $3,500–$7,000+ |

| Event Organisers (Major Events) | Very High | $4,000–$8,000+ |

So, what’s “acceptable”? If your public liability premium starts climbing above the industry average without an apparent reason, like a recent claim or business expansion, it’s time to shop around. A spike can be a red flag. Use the table above to ensure you don’t overpay, and always get at least 3 quotes as a rule of thumb.

Can You Reduce the Cost Without Cutting Corners?

Absolutely. And you should. Smart risk management can shave serious dollars off your premium over time. Here are some tips:

- Invest in safety training for your team, especially in high-risk environments like construction sites or commercial kitchens.

- Display clear signage to warn customers of wet floors, hot surfaces, or restricted areas.

- Maintain detailed records of all maintenance, inspections, and cleaning schedules. This demonstrates proactive safety management and can support your defence in the event of a claim.

- Implement incident reporting procedures so near-misses and hazards are addressed before they become insurance claims.

- Review contracts and supplier agreements to identify where third-party liability may apply.

- Bundle policies where possible. Combining public liability with commercial property or vehicle insurance can reduce your overall premium.

- Avoid automatic renewals and always get competitive quotes each year. The insurance market shifts regularly, and loyalty rarely equals savings.

- Adjust coverage strategically. If your largest contract only requires $10 million coverage, there’s no need to pay for $20 million. Tailor it to your actual risk exposure.

Taking these proactive steps not only reduces your premiums but also strengthens your position if a claim arises.

Is public liability insurance legally required?

Not always. There’s no universal law requiring every business to have it, but many councils, landlords, and clients won’t work with you unless you do. It’s often a prerequisite for permits, licences, or working with the public. Higher risk industries should definitely consider it from the start.

Where is public liability insurance mandatory or strongly expected?

- Construction and trades: Essential for site access and licensing.

- Event management: Major events that garner hundreds to thousands of participants are required by venues and councils for public safety.

- Hospitality (cafés, bars, restaurants): Commonly required by landlords and local regulators.

- Market stallholders: Often can’t trade without proof of cover.

- Medical and allied health services: These are required by many professional associations and landlords.

When will landlords or clients ask for it?

Landlords and clients will usually ask for public liability insurance whenever you’re signing a lease or tendering for a contract. Commercial landlords typically require a Certificate of Currency before allowing tenancy. Larger clients and procurement teams often make it non-negotiable—no cover, no deal.

Costly Mistakes to Avoid When Choosing a Policy

Choosing the wrong policy can be more expensive than having no policy at all. Here are the most common costly mistakes to avoid:

- Underestimating your risk: Thinking “it won’t happen to me” leaves you exposed. Even low-risk businesses can face unexpected claims.

- Going for the highest excess to lower premiums: A high excess might look appealing, but if you can’t afford to pay it when something happens, you’ll be stuck.

- Letting your policy go stale: As your business grows—more staff, new locations, bigger clients—your risk profile changes. Make sure your policy reflects that, and is updated annually or when significant shifts occur.

- Ignoring the fine print: Some policies exclude subcontractors or certain activities, such as festivals or seasonal events. Others might cap coverage based on business type. Always read the exclusions and be aware of what applies to your business.

Don’t wait until an accident turns into a lawsuit. Get the cover you need, understand what you’re paying for, and protect what you’ve built.