Understanding the Importance of Lead Generation for Mortgage Brokers

Lead generation for mortgage brokers is a crucial strategy to remain competitive in the industry. Now more than ever. While referrals from friends and family remain a strong source of business, they only go so far. Today, many of your potential clients turn to online platforms like Google Search, various social media platforms and Google Maps to find a trusted broker.

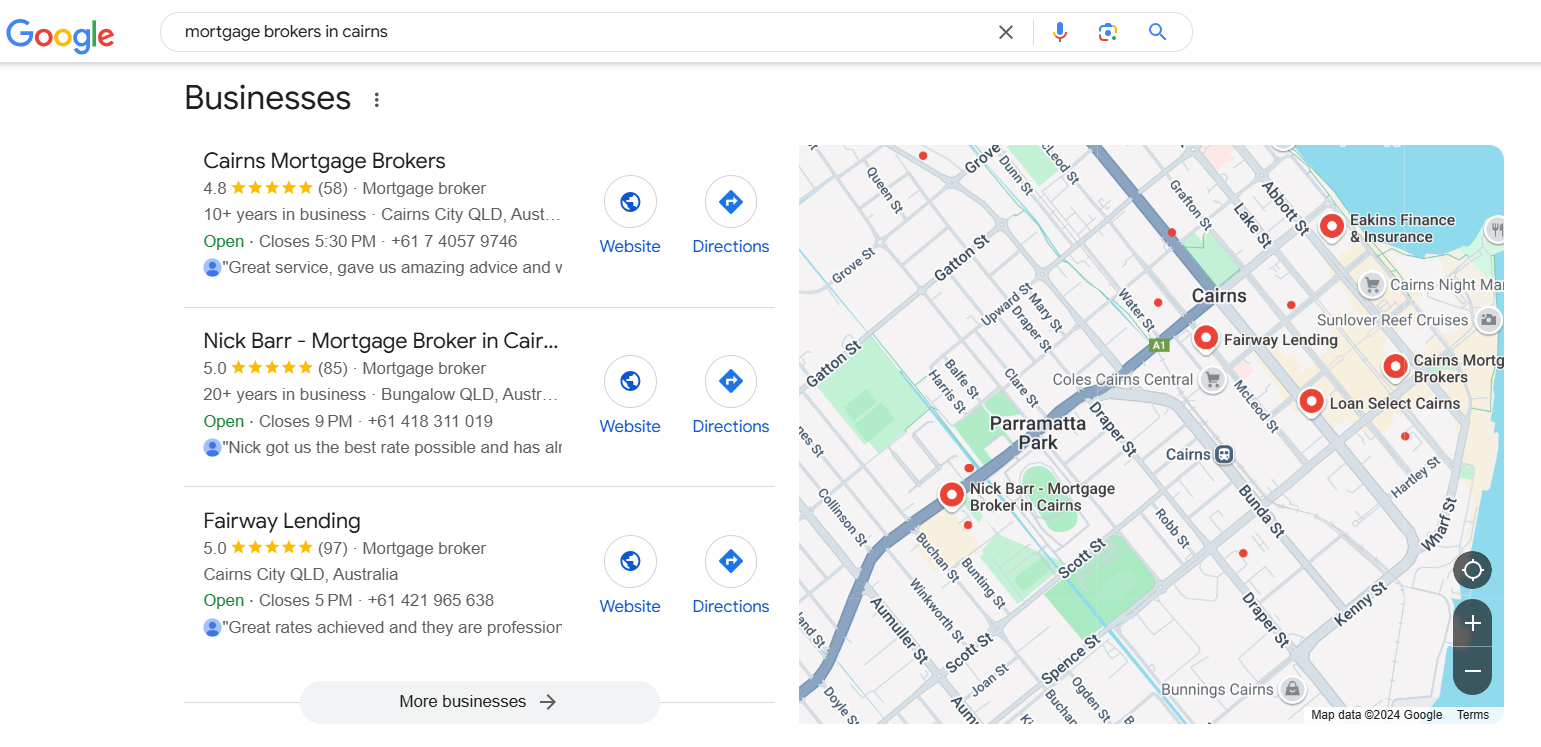

Your marketing strategy needs to align with generational preferences as they play a significant role in how people find mortgage brokers. Older generations, who value face-to-face connections, often use Google Maps to locate brokers nearby and opt-in to call them.

On the other hand, younger clients, who are typically more comfortable with technology, are open to online interactions, like social media, trusting the convenience and immediacy of online communities and search engine results.

Mortgage brokers in their 30s to 50s are ideally positioned to capitalise on these trends by using tools such as CRM software, email automation platforms, and social media scheduling tools, as well as strategies like targeted Google Ads campaigns and local SEO optimisation.

Mastering these approaches will increase sales by meeting the needs of a broader demographic and the evolving trends of how people discover their brokers. This article will break down these strategies for brokers who want to improve their sales game.

Knowing Your Target Audience and Their Pain Points

Lead generation for mortgage brokers requires a deep understanding of our target audience.

The challenge: Imagine a first-time buyer overwhelmed by the jargon of mortgage terms and unsure of where to start. They’re worried about finding a fair deal while navigating the complexity of loan approvals. Do they go to the bank? Do they go to a broker? Is there a fee involved? Think about what questions your ideal client has in their mind.

Or picture a person wanting to refinance their home due to high interest rates, but they feel stuck because they don’t have the time to research better options. Each story represents a distinct group—first-time buyers, refinancers, property investors, and retirees—who are all seeking solutions tailored to their needs, which are all different.

Your role: As their professional guide, you should offer them clarity, simplify the process, and, most importantly, build trust. First-time buyers might need reassurance that they’re getting the lowest possible interest rate, while refinancers may value a broker who promises faster approvals with minimal paperwork.

The solution: Clarify with them in simple terms what the best approach for their circumstance will be, as well as your role in the process. When it comes to securing a mortgage, every client has unique priorities and challenges. That’s why your advice should address your client’s specific needs and make the process as seamless as possible.

Here’s how you can deliver precisely what they’re looking for:

Low interest rates – If securing the best deal is the top priority, leverage your extensive network of lenders to shop around for the lowest rates. Make it clear your expertise ensures your clients get competitive terms that fit their financial goals.

Streamlined process—Are your clients worried about getting overwhelmed by paperwork? Focus your sales pitch on your expertise in streamlining mortgage documentation to ensure a hassle-free experience.

Quick approval—Do your clients need a fast turnaround? In your communication, ensure you prioritise their application and emphasise the turnaround time and how you can move them forward to approval without unnecessary delays.

Peace of mind – Are they feeling overwhelmed? Emphasise that you can guide them every step of the way. From answering their questions to resolving any concerns, tell your clients that you will provide clarity and confidence throughout the mortgage process.

Crafting your messaging to align with the client in front of you is essential when creating lead generation for mortgage brokers. For the first-time buyer, your pitch could be: “Let us guide your decision-making process and handle the paperwork and communication to the lender, seller and conveyancer. ” For the retiree: “Secure the financial freedom you deserve and let us research the most suitable mortgage options designed for your golden years.”

Your narrative is about painting a picture of what life could look like with you as their guide. Combining empathy with expertise ensures you’re not just addressing their needs, you are exceeding them.

Building your foundation for lead generation for mortgage brokers

Once you figure out your target market and learn to craft your message to address their pain points, you can start building your foundation for lead generation by focusing on the basics:

Craft your brand narrative

Building a brand is about painting a picture of what life can look like when clients choose to work with you. Think about what makes you unique in simple terms and how you can be the solution by speaking directly to your client’s problems in every piece of marketing or sales conversation you create. It’s about providing honest, authentic value packaged as a service while connecting on a personal level to the human in front of you.

By understanding their needs and offering expertise, your brand should stand out as something they can count on to guide them. Use that in your copywriting in every opportunity you have to present your brand. Avoid speaking about yourself, avoid the typical sales pitch (“we offer low rates” or “we have 24/7 support”) and avoid complex words no one understands.

Optimise your digital presence

To attract and engage potential clients in today’s digital age, a robust online presence is paramount. A well-optimised website and a strong Google Business Profile are foundational elements of a successful digital strategy for mortgage brokers.

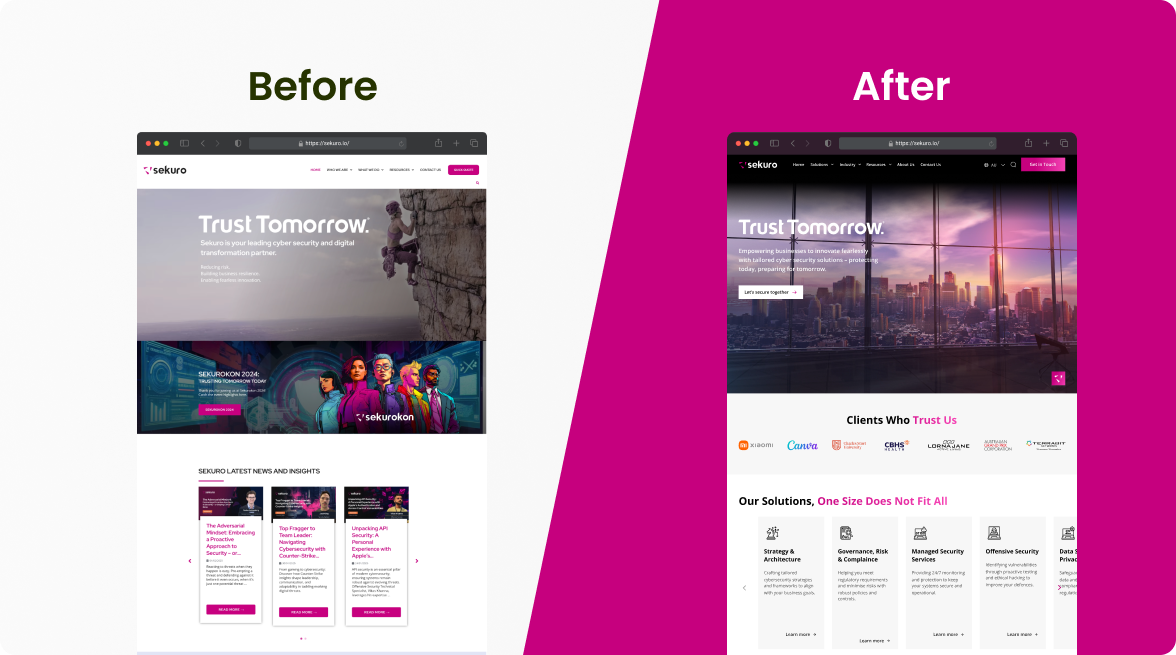

Create a user-friendly website

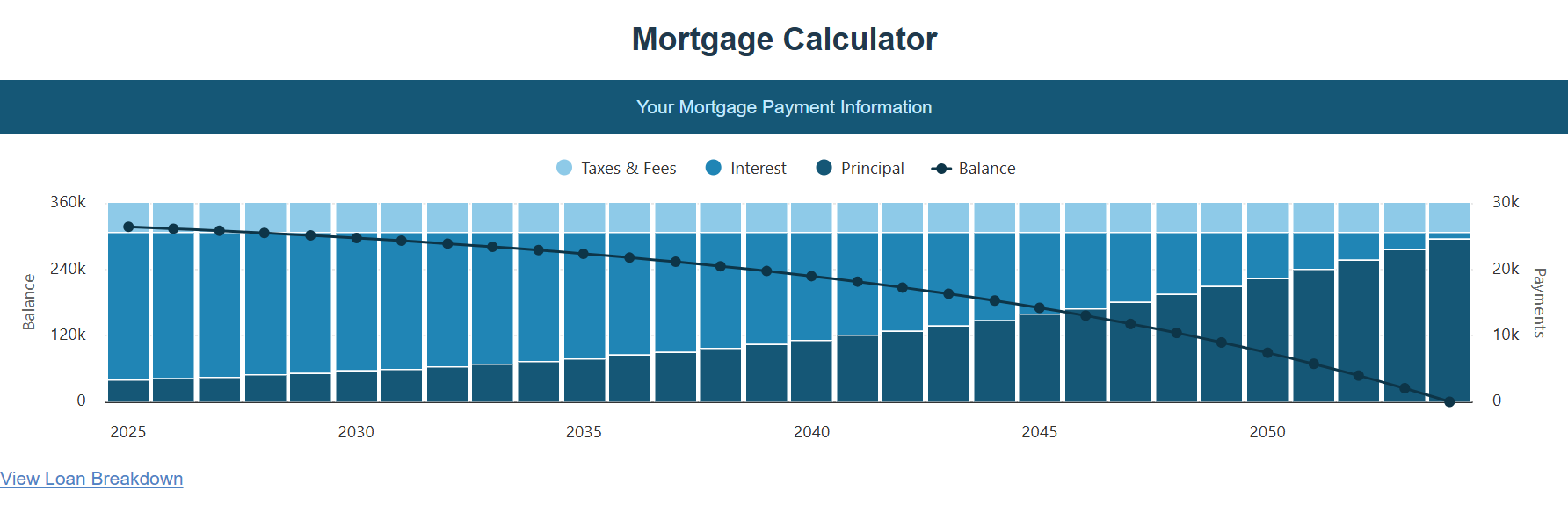

Your website should serve as a digital storefront, reflecting your brand and offering valuable information to potential clients, such as detailed mortgage guides, repayment calculators, and FAQs addressing common concerns. It should be easy to navigate, visually appealing, and optimised for mobile devices.

Key elements to consider include:

- Clear and concise information: Present essential information about your services, experience, and team in a clear, simple and concise manner.

- Engaging content: Create high-quality blog posts, articles, and downloadable guides that address common questions and concerns of potential clients.

- User-friendly design: Ensure your website is easy to use, with a clean layout and intuitive navigation.

- Call-to-action: Clearly define the desired action for visitors, whether it’s contacting you, requesting a quote, or scheduling a consultation.

Leverage your Google Business Profile, which is a powerful tool to enhance your local SEO and attract nearby clients. By optimising your profile, you can increase your visibility in Google Maps and Search results, and improve your website ranking.

Key strategies include

- Accurate and up-to-date information: Ensure your business name, address, and phone number (NAP) are accurate and consistent across all online platforms.

- Keyword optimisation: Incorporate relevant keywords like “mortgage broker,” “home loan,” and “refinancing” into your business description.

- Positive reviews: This is one of the strongest indicators of the Google Maps ranking algorithm. Encourage satisfied clients to leave positive reviews on Google Maps.

- Regular posts: Share updates, promotions, and industry news through Google Posts to keep your profile active and engaging.

- High-quality photos: Use high-quality images of your office, team, and services to create a professional and visually appealing profile.

Additionally, while Google My Business account details directly impact local search visibility, it’s important to remember that website ranking is a key indicator of Google My Business profile strength, along with other SEO efforts like gathering customer reviews.

Strengthen your content game

A robust content strategy is essential to truly standing out in the competitive mortgage industry. High-quality, informative content attracts potential clients and positions you as a trusted advisor. By creating valuable resources, you can build credibility, generate leads, and nurture long-lasting relationships with your audience. Let’s cover the main points of crafting compelling content.

Craft compelling content

- Create high-quality content: Produce well-researched, informative, and trending content. These could be informative blog posts, engaging videos where you give your own perspective, or interactive tools like calculators, quizzes, and checklists so your target audience can make better and informed decisions.

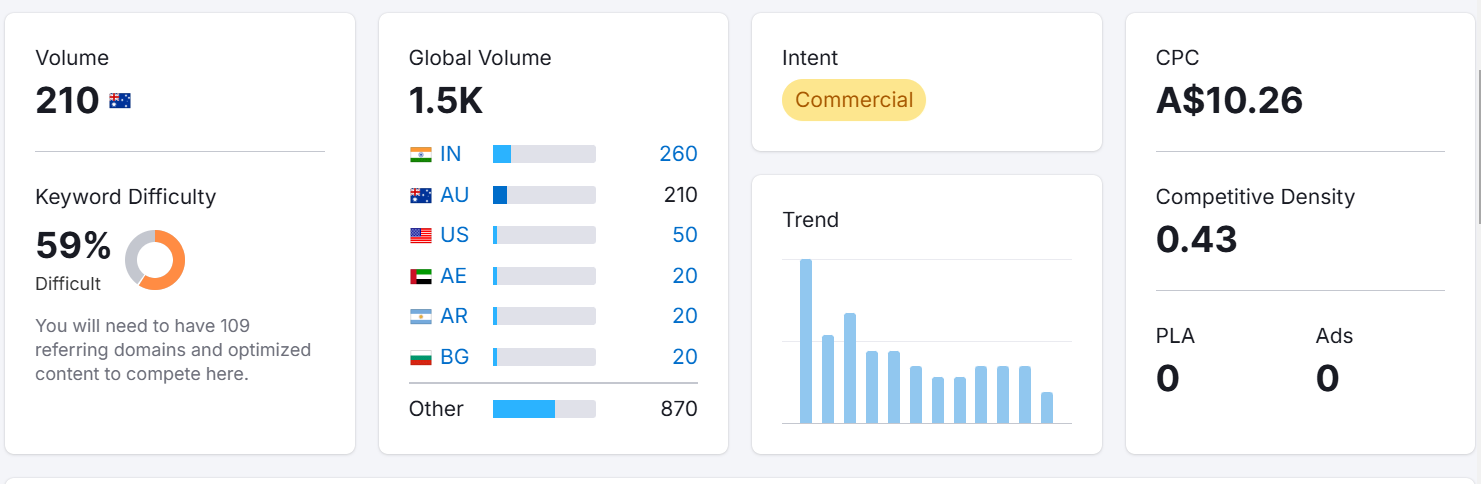

- Optimise for SEO: Incorporate relevant keywords and phrases into your content to improve search engine visibility. Use tools like Google Keyword Planner to identify high-traffic keywords people are using to find you.

- Leverage visual content: Incorporate visuals like infographics, charts, and videos to enhance your content. Visuals can make complex information more digestible and appealing.

Consistently creating high-quality, relevant content can attract and retain potential clients, build brand awareness, and establish yourself as a trusted authority in the mortgage industry.

Build trust with social proof

Wherever you put your content in front of people, on landing pages, posts and the like, find opportunities to highlight client testimonials or compelling case studies. These endorsements reinforce your credibility and make prospective clients feel more confident in choosing your services.

Generating Mortgage Leads with Proven Digital Advertising Strategies

Once you’ve established yourself as an expert on your website and generally throughout your digital presence, you can expand to digital advertising, SEO, networking, and lead nurturing.

Try not to focus on paid marketing online unless your presence and authority perception is acceptable. You will have missed opportunities, and the following types of marketing efforts won’t be so effective when crafting lead generation for mortgage brokers.

Google Ads

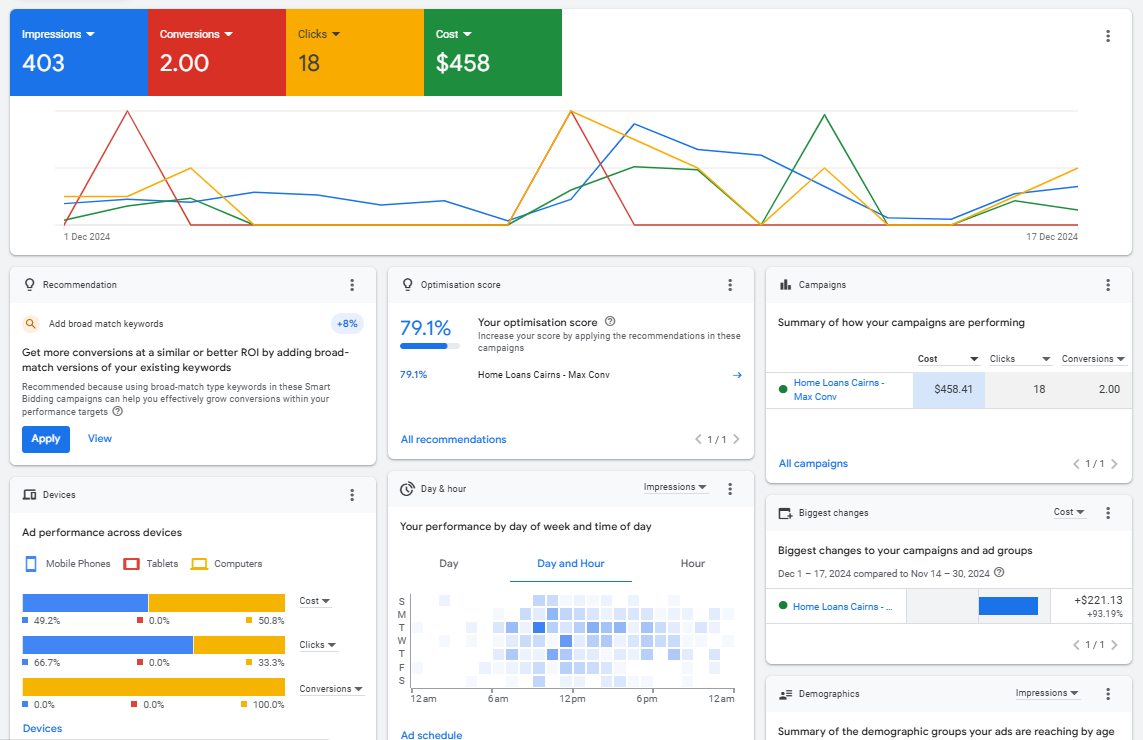

Using Google Ads as a sstrategy is one of the most powerful tools for mortgage lead generation. By targeting high-intent keywords such as “best mortgage rates” or “mortgage broker near me,” you can reach potential clients who are actively searching for your services.

The key to success with Google Ads lies in continuous optimisation—testing different ad copies, targeting strategies, and bidding models. Those who invest in well-crafted campaigns see great results.

SEO marketing

Investing in SEO helps your website rank higher in search engine results, making it easier for prospective clients to find you. Focus on local SEO by optimising your site for city-specific terms like “mortgage broker in [city]” to attract nearby clients. Regularly publish fresh, keyword-rich content such as blogs, case studies, and educational guides to boost your organic visibility.

Partnerships and networking

Collaborating with trusted professionals in complementary industries, such as real estate agents, accountants, and financial planners, can help you share leads and expand your reach. Attend local housing expos, webinars, and networking events where you can build relationships with potential referral partners and clients. Networking strengthens your reputation and can lead to long-term, mutually beneficial partnerships.

Lead nurturing

Effective lead nurturing is vital to converting inquiries into clients. Use email campaigns that provide personalised, valuable content like first-time homebuyer guides, rate comparison tools, and tailored loan recommendations. Regularly communicating with leads through newsletters and targeted offers keeps your business top of mind and builds trust over time, increasing the likelihood of a successful conversion.

Using Creative and Unconventional Approaches

Despite being in the digital age, lead-generating and marketing approaches are not limited to this aspect. Creative and unconventional, and sometimes even the long-forgotten traditional approaches can help you generate leads you might otherwise miss.

Community engagement

Building a strong local reputation can be a game-changer. Sponsor local events, charity drives, or community activities to increase brand visibility and demonstrate your commitment to the area. This not only enhances your reputation but also fosters a personal connection with potential clients, increasing trust and engagement.

Find local marketing solutions

In addition to digital marketing, local outreach can help you connect with prospective clients. Distribute flyers in targeted neighbourhoods or community centres to capture attention where your audience lives. Regional radio ads and podcasts are also a cost-effective way to reach local homeowners and property investors, promoting your services on air and increasing brand awareness.

Video marketing

With the rise of social media, mortgage brokers are using platforms like YouTube, Instagram, and TikTok to share educational videos on the mortgage process and market trends. These short, engaging videos answer common questions about home loans and property investing, offering value to your audience.

By becoming a trusted expert and authority in your field, you can attract a steady stream of leads. Many brokers who consistently provide insightful content are seeing significant growth in their client base as they become go-to resources for financial guidance.

Interactive lead magnets

Offer interactive tools like a free mortgage eligibility checker or repayment calculator to capture leads. These tools not only provide value to your audience but also encourage potential clients to engage with your services. When people feel empowered by these resources, they are more likely to convert into clients. Take this into account when thinking of lead generation for mortgage brokers in the current market.

Monitoring and Refining Strategies

To truly optimise your lead generation efforts, it’s crucial to leverage data analytics. Tools like Google Analytics and Google Search Console provide invaluable insights into your website’s performance.

By tracking metrics such as website traffic, user behaviour, and conversion rates, you can identify areas for improvement and make data-driven decisions. For example, analysing your website traffic sources can help you allocate resources effectively; while understanding user behaviour can help you optimise your content and website design.

Google itself offers a wealth of data to refine your paid advertising campaigns, including tools like the Keyword Planner to identify high-intent search terms, the Performance Planner to forecast results, and detailed reports on click-through rates, conversion rates, and ad placements.

By monitoring metrics like click-through rate, conversion rate, cost per acquisition, and return on ad spend, you can identify underperforming keywords, ad groups, and landing pages. Making adjustments such as refining keyword targeting, improving ad copy, optimising landing pages, and adjusting bids can significantly improve campaign performance.

Consider implementing tactics like A/B testing, personalisation, lead nurturing, and customer feedback to optimise your lead generation efforts and drive sustainable growth for your mortgage brokerage business.

Finding Strategies to Get Leads

While traditional methods like online advertising and content marketing remain effective, diversifying your lead generation strategies is essential to stay ahead of the competition. By exploring innovative approaches and adapting to market changes, mortgage brokers can attract a wider audience and generate more high-quality leads.

Consider exploring emerging channels like social media marketing, focusing on platforms such as Instagram and Facebook for visually engaging content, and LinkedIn for professional connections. Collaborate with influencers who specialise in financial education or real estate to reach a targeted audience effectively. These platforms offer unique opportunities to connect with potential clients on a personal level and build brand awareness.

Don’t be afraid to experiment with new strategies and measure your results. By continuously optimising your approach, you can attract more leads, close more deals, and grow your business. Talk to us so we can discuss lead generation in more detail.